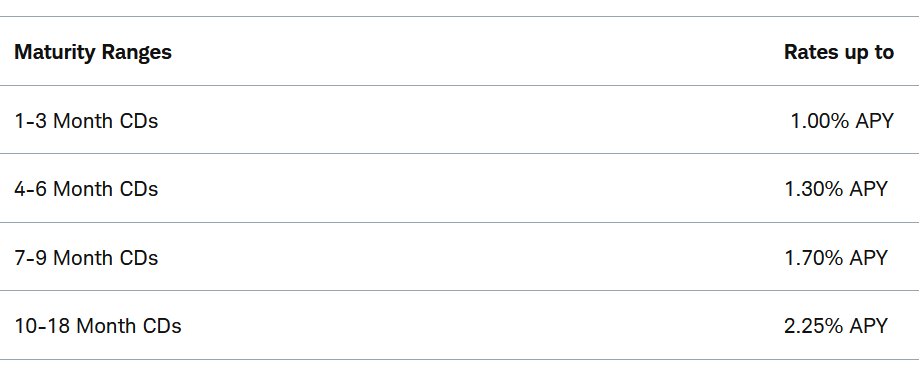

Certificate of Deposit

At IBCM, we offer Certificate of Deposit (Fixed Deposit) and give you an amount of interest for a specified period of time and return your money on the specified date. These certificates are federally insured and issued by banks and savings-and-loans institutions. Compared to regular savings accounts, CDs offer a higher yield to compensate for the loss of liquidity. They also represent a low-risk investment opportunity because the account holder needs little understanding of investment markets and they’re insured up to $250,000.

- Steady and predictable

- Broad Selection

- Low Market risk

- High Interest rate up to 10%

While banks assess penalties on CD customers who withdraw from their principal deposit before the date of maturity, some banks allow the CD owner to withdraw from the interest accrued during the CD’s term, although this would reduce earnings.

What customers say about us

We have gotten some positive reviews in the past. Here are some of them.

I have found this bank to be outstanding in all ways, since I moved personal and business accounts there a years ago. They have the best rates and best customer service of all the other banks. It's like dealing with a small personal bank with big bank capability. Their money market rates are excellent and safe.

John Eden

CustomerI recently opened an account and their representatives were extremely helpful in explaining how to use and make transactions through this site. I was very impressed with their banking features and the service team. I would recommend this bank for anybody who is looking for a company who has your back and best interest at heart. Thank you!

Ethan Smit

Premium CustomerI’m very impressed with the assistance provided by customer service at Customers Bank! I was looking to open a new account, but was hesitant to pull the trigger. I had many questions that the customer service representative was able to address & answer with ease & patience to ensure I understood completely in order to make the best decisions. Thank you so much to the customer service team for making this process easy!

Brat Lucy

Customer

Compare us with others

We have proven to be the best so far. Compare us with other Banking facilities and see the clear winner.

| Service | IBCM | Other Banks 1 | Other Banks 2 |

|---|---|---|---|

| Overdraft up to $200 | |||

| 5 Tier Support System | |||

| Low Opening Balance | |||

| Smart Notification | |||

| Small Business Support | |||

| Large Business Support | |||

| One Touch UI |